As a direct consequence of the pandemic, there is a growing interest among drivers in usage-based insurance products. Check out DIA's white paper to understand how DriveQuant plays a role in this.

The COVID-19 pandemic and all related measures forcing people to stay at home have awakened a desire for fairer motor insurance products. Policyholders have suddenly felt entitled to a refund while their vehicle was staying in the driveway. At DriveQuant we believe that part of the solution lies in the analysis of driving data to better assess risks and to set up fair and transparent programs. This is why we enable motor insurers to build usage-based products within weeks, by either designing turnkey telematics white-label mobile apps or by transforming any existing application into a telematics and driver coaching device thanks to our DriveKit SDK.

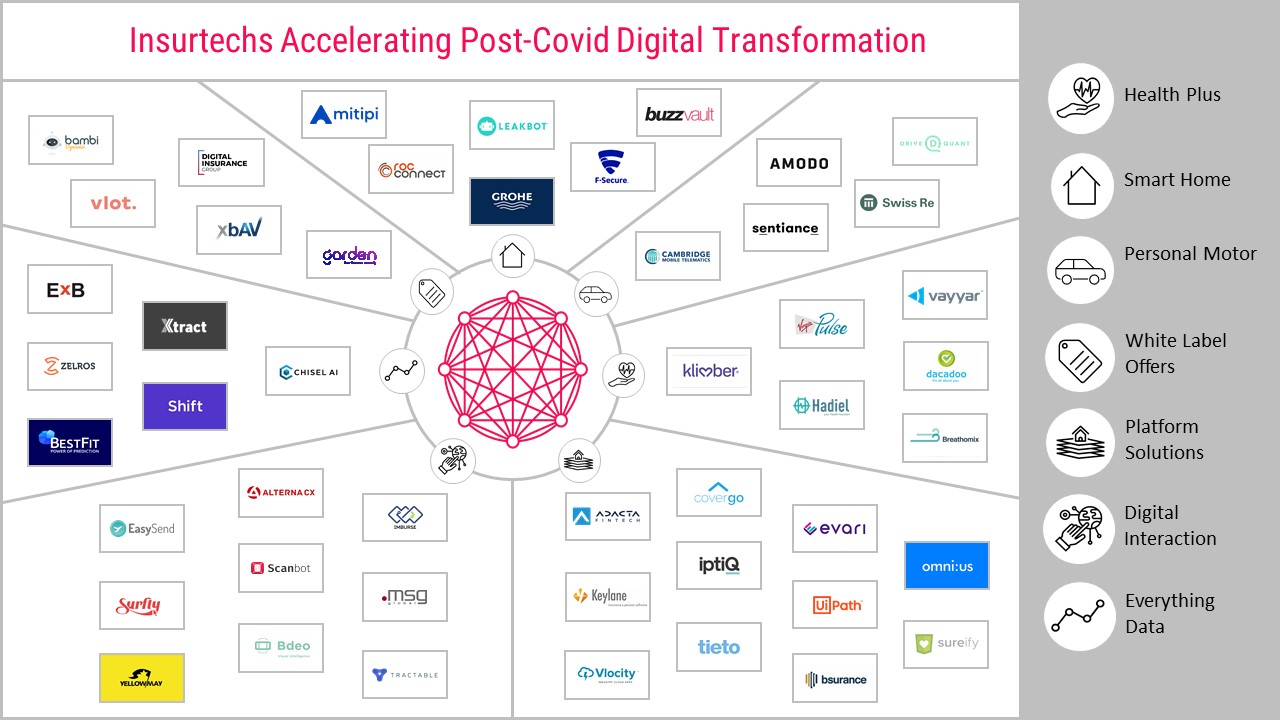

Check out our feature in the DIA White Paper ‘The Impact of Covid on the Speed of Digital Transformation in Insurance’: