The article is intended for car insurance product managers seeking a reliable and affordable solution to collect driving data and understand the driving behaviour of their policyholders for road safety and connected insurance purposes.

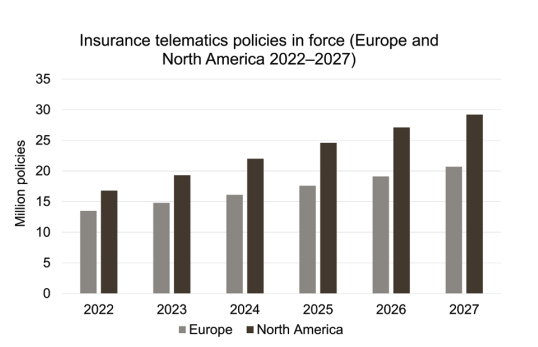

According to a new report published by Berg Insights, there are already about 31 million active insurance telematics policies in Europe and the US. The number of active telematics policies in these regions combined is expected to reach 50 million by 2027.

As insurance telematics policies gain ground among policyholders, insurers are looking for affordable and reliable solutions to collect driving data. Telematics boxes, which used to dominate the telematics market in the early 2010s, have been increasingly challenged by more convenient technologies including smartphones and connected cars. While connected cars have generated many expectations, many obstacles still need to be overcome before it becomes a viable solution. Therefore, the only credible technology for the decades to come is smartphone telematics.

Smartphone telematics is a unique solution because it’s both universal and affordable. It’s universal because every driver in the world owns a smartphone. As a reminder, there are more mobile phones than human beings in the world. This means that regardless of the car manufacturer, model or production date of their car, all insurers' customers can benefit from the same connected insurance products. Smartphone telematics is also affordable because it’s a software solution. It doesn’t require any additional hardware to plug into the car in order to collect driving data and to analyse driving behaviour. Policyholders just need to download a telematics app and allow permissions for data collection.

When considering smartphone telematics adoption, insurers are faced with two options: personnalising a telematics white-label application or integrating a mobile telematics SDK into their existing app. In this article, we focus specifically on the mobile telematics SDK. We define what is a SDK, the benefits of integrating a mobile telematics SDK and three specific use cases for insurers.

What’s an SDK?

A Software Development Kit (SDK) refers to a collection of tools designed for the creation and development of softwares and applications. A mobile SDK relates to a kit of tools that facilitates the enhancement of a mobile application without the need to spend time developing the feature on a mobile operating system (Android or iOS).

Usually, a mobile SDK is composed of several components. A component is made of one or more modules. The mobile SDK is also supported by documentation to explain how it works, and sometimes by calls to third-party services in the form of APIs.

What’s the top 5 benefits of integrating a telematics SDK into an insurance app?

More and more insurers, in particular in North America and in some European countries (UK, Germany and Denmark) have already launched smartphone-based insurance products by integrating a telematics SDK into their app. Here are the top five advantages they cited.

Leverage a single mobile application

Integrating a telematics SDK into an insurance application offers the advantage of not having to ask policyholders to download another application on their smartphone. Policyholders just need to update the insurance application on their smartphone and allow the required permissions to benefit from the telematics services.

An evolutive technology

Given that telematics SDKs are a software-based solution, a regular app update can extend the lifespan of the services by making it compliant with the newest Android or iOS requirements. Later on, if an insurer wants to introduce new telematics features such as crash detection or driving challenges, it just needs to release a new update that activates these new features.

Offline work

One of the features that insurers appreciate the most is offline work. Even though mobile data is turned off or that there is no data connection available, the telematics SDK still collects the driving data. The data is stored locally and later automatically transmitted to the server for analysis when the data connection is available again.

No battery drain and low data usage

To benefit from automatic trip detection, users are required to allow special permissions including “ignore battery optimisations”. However, that doesn’t mean that the telematics SDK drains the smartphone’s battery. The best telematics SDKs available in the market are optimised to have a very low impact on both battery consumption and data usage (about 5 kb per minute of driving).

Pricing

As said above, smartphone telematics is as efficient as other technologies while being more affordable. Generally, the pricing model of a telematics SDK is made of a one-time integration fee combined with a fixed monthly per-user fee. That makes this solution more cost-effective than hardware telematics solutions that involve installation, maintenance, and replacement fees.

What are the use cases for integrating a telematics SDK into an insurance app?

Connected insurance

For insurers familiar with driving data exploitation, it makes sense to integrate a telematics SDK into their existing app to launch a connected insurance program. The SDK integration into the insurance app contributes to delivering a frictionless and more relevant user experience.

Connected assistance

From a policyholder’s point of view, the primary purpose for downloading an insurer app is to get direct access to the insurer’s assistance. Therefore, integrating a telematics SDK into its app is the best choice for an insurer that wants to implement telematics services such as connected assistance services and crash detection.

Eco-driving coaching

To keep policyholders engaged and improve retention rate, insurers need to deliver value-added services. Eco-driving is relevant both for insurers, because it contributes to improving safer driving behaviour, and for policyholders, because it helps them make savings by optimising fuel consumption while reducing their CO2 emissions. Integrating this feature into an insurance app is the best way to make sure that users will regularly open the app to check out the coaching tips.

Verdict: Are telematics SDKs the best technology for connected insurance products?

Launching a profitable connected insurance product requires optimising data collection. At the same time, insurers need to reduce the cost and complexity of their telematics solution to be more competitive. Given the relevance of the technology to connected insurance use cases, smartphone telematics is the only credible solution. And for insurers that already experimented successfully with driving data, integrating a telematics SDK into their app is the best option.

Watch Romain Lebègue, Marketing & Product Director, and Thomas Fournier, Deputy General Director, at Roole, France's leading car club with more than 1,3 million members, explain why they opted for integrating DriveQuant’s telematics SDK into the Roole premium app and what they gained by doing so.