The precise assessment of risks and the resulting insurance premium pricing policy are two major issues for insurers. Indeed, on the one hand, car insurance policyholders have seen their premiums increase overall and do not understand these increases, and on the other hand, insurers are seeing their "combined ratio" deteriorate. Fitch Ratings forecasts that the sector's combined ratio worldwide will reach 108% this year. In other words, the sum of compensation and expenses added to operating expenses exceeds the total premiums collected by 8 points. From a strictly technical point of view, car insurance would be in deficit.

Policyholders are asking for the right price

Policyholders, and especially good ones, consider that they pay too much. In addition, the majority of drivers consider that the traditional criteria for setting car insurance premiums are inadequate or even outdated. Following the recent generalized increases in car insurance premiums: "good drivers feel they are paying for high-risk drivers", logically they find these rates illogical and unfair. Only 20% of auto policyholders spontaneously state that they have a clear idea of how their insurers set premiums. This is an extremely low figure, considering the current requirement for price transparency in all sectors of activity. Will the insurance sector be able to avoid this requirement for transparency in the long term? This is the challenge facing insurers: fairer and more transparent rates, so that they can keep their "good customers".

Good drivers no longer want to pay for high-risk ones

When drivers are asked how their premiums should be set: 73% answer that premiums should be based on how they drive and the actual level of risk it represents. It's very simple! Today, good drivers no longer want to pay for high-risk drivers. This is very understandable and obviously rational considering that drivers classified in the decile most exposed to the loss (10%) cost twice as much to insure as those in the lowest decile (10%).

Mobile telematics apps to better assess road risk

At the same time, the advent of embedded telematics technologies, particularly via smartphones, has made it possible to predict risk behaviors 50% more effectively than the methods traditionally used by insurers, thanks to data extraction.

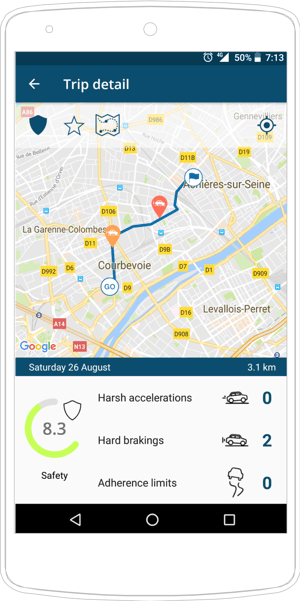

The explanation is extremely simple: insurers never have access to certain factors that explain a high claims rate. For example, an insurer will never know if a driver frequently uses his mobile phone at the wheel, which is a major road risk factor, nor will he ever know if his insured is familiar with excessive speeding, sudden braking, or even his behavior in curves.

Mobile Apps make it possible to improve long-term relationships with the right customers

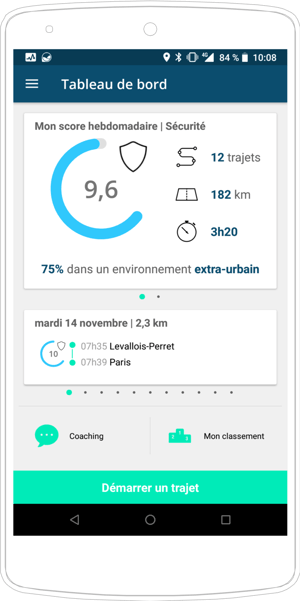

These data can be automatically measured using on-board telematics and are obviously the most reliable metrics for predicting the risk of road accidents. The company can have access to it and better segment its policyholders according to their degree of risk exposure and thus retain its best customers by offering them more attractive rates.

"One of the major assets of telematics, in addition to allowing almost tailor-made pricing, "how you drive", adds Augustin Leman, Sales Director at Drive Quant, "is also to create new points of contact by moving the insured from payer to partner. In other words, insurers can help insureds to better understand their risks via embedded telematics applications, and can open areas for dialogue with them in terms of preventing and predicting technical incidents on the vehicle".

"One of the major assets of telematics, in addition to allowing almost tailor-made pricing, "how you drive", adds Augustin Leman, Sales Director at Drive Quant, "is also to create new points of contact by moving the insured from payer to partner. In other words, insurers can help insureds to better understand their risks via embedded telematics applications, and can open areas for dialogue with them in terms of preventing and predicting technical incidents on the vehicle".

Moreover, Augustin Leman points out, "on-board telematics allow the insurer to have a lot of information in real time on the conditions of the accident in the event of a claim being made. And so, on the one hand, it can shorten processing and compensation times (which can make the insured happy), and on the other hand, it can help the company reduce the costs inherent in claims management. This last point is in line with the current economic situation and can only be virtuous for companies. Finally, smartphone-based telematics apps allow tests to be carried out and are less expensive to implement than those requiring the installation of a hardware."

Insurers, by using new mobile telematics solutions, could establish more accurate pricing, and thus meet the requirements of their best customers and enhance retention.