The digitization of different uses and the evolution of technology impact the whole automotive ecosystem. Just as our ancestral cell phone became a smartphone, our traditional car is yet becoming a smart car, thus creating new business models. Manufacturers, car dealers, car repair, car insurance, all are likely to get into this great disruption movement. The car insurance industry is also being shaken up. In the era of connected cars, insurers must also be part of the game to be always closer to their customers expectations.

Lifetime car insurance, Tesla on the front line

One of the first example of disruption in the car insurance industry has been Tesla. By tapping into the Asian market, the California company had the idea to offer car insurance for life, by offering its clients maintenance plans together with the car purchase. Thus, Teslas were sold with a personalized car insurance policy that incorporated the specific characteristics of the autopilot mode, but also the maintenance costs of the electric vehicle.

Since the "autopilot" mode was supposed to imply a reduction in the number of claims, Tesla considered it logical that its customers should benefit from an adjustment in rates. Moreover, as we know, electric vehicles have much lower maintenance costs than combustion engines. Tesla therefore chose to include this offer in the purchase price of the car.

The customer has a "long-term" vision of the cost of his vehicle and is rid of these monthly invoices. Elon Musk, CEO of the firm, opportunely stated that he was not seeking to disrupt the market but to encourage insurers to "charge rates proportionally adapted to the risks of a Tesla".

"Pay as you Drive": a brainteaser for traditional car insurance

Very popular among urban youth, "pay as you drive" car insurance could be translated as "mileage insurance". People actually pay a contribution that depends directly on the number of miles they drive.

In most cases, your insurer starts by charging you a fixed annual premium in the first year. Then you will only be charged for the miles driven, the rate per mile depending on your driver profile: risk, history, bonus-malus etc.

The upsides of the “Pay as You Drive” formula

First of all, what you need to know is that to benefit from most of the "Pay as you drive" programs, you will have to drive less than 5,000 miles per year. You will save between 20 and 30% compared to a traditional car insurance premium, and you have the same levels of coverage as any other type of insurance.

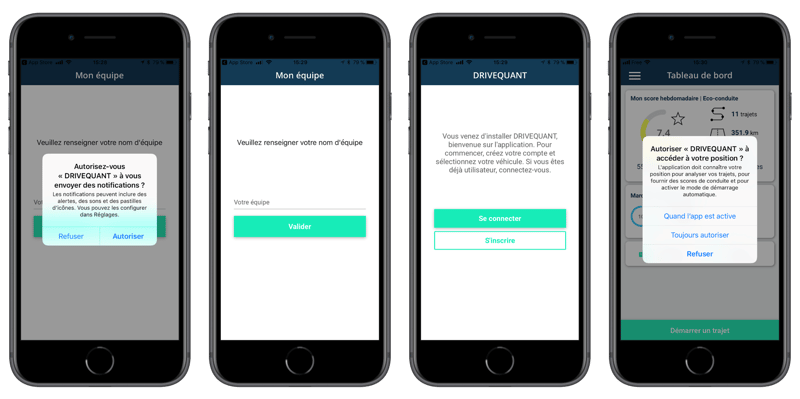

There are also insurances whose premiums are set according to driving conditions: on weekends, in town or in the countryside, at night... Generally, you are required to equip your car with a dongle. The installation of this dongle can be free of charge or at your expense depending on the company chosen. Some insurers have also opted for connected embedded telematics solutions via smartphones such as DriveQuant.

Your smartphone or the dongle, detects your trips, your travel times, the types of roads you use... In Europe, the implementation of these contracts is ruled by controlling the collection and use of individual data (GDPR).

The smartphone will make roads safer

A majority of policyholders want to see the amount of premiums adapted to the real risk. This is how the connected insurances emerged.

Indeed, bonus/malus systems are frequently called into question, good drivers feel that they are paying for the bad ones. The progress of communication networks and processors allows motorists to be more and more connected and to transmit very precise information on road behaviour. The smartphone is now able to transmit directly to your insurance company: the number of miles driven, traffic hours, journey time, etc. Your insurer will be able to know everything about your driving. The resulting insurance price can therefore be directly impacted. In other words, if you are a good driver, you will pay less.

Encouraging safe driving...

These connected insurances are a source of advantages for both policyholders and insurers. They make it possible to adjust rates precisely and to develop the traditional insurance model in a more equitable way. But they also encourage safe driving by offering a tangible reduction in the price of insurance in the event of good driving. Which at the level of society is obviously virtuous.

In addition, connected insurance can shorten reimbursement procedures, especially in the event of an accident for example. The insurer can access your driving data via the smartphone. He will be able to carry out the report himself and may, if necessary, speed up the procedures.

Some solutions, such as DriveQuant, also offer coaching features that improve your driving and possibly allow the driver to enjoy lower premiums. This new way of looking at insurance means a more personalized relationship between drivers and insurers.