SCOR & DriveQuant offer you this joint expert view article. You can also read it on SCOR website! If you have any question, reach us here. If you want to learn about SCOR & DriveQuant's 360 connected insurance offer, click here!

Introduction

When the pandemic hit the world at the beginning of 2020, many thought that road accidents would decrease. It was not hard to understand this logic - People were locking themselves in. No commute to work. No traveling. Naturally, less driving, hence fewer road accidents.

Fast forward three years. It turned out that assumption was not accurate.

This historic pandemic caused many lost lives, not just from the virus itself; its side-effects were as severe or even worse than the disease itself. Road fatality is one of the unexpected adverse side effects of the pandemic. The rapid increase in road traffic collisions is becoming a serious global health, life, and business problem, causing around 1.35 million deaths per year worldwide and costing around $1.8 trillion every year.

In the US, for example, the Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) reported that traffic fatalities during the first half of 2021 increased by 18.4% since the first half of 2020, despite the drop in ridership. The estimated 20,160 fatalities during the first half of last year are the highest since 2006. Other countries such as Colombia, Israel, France, and Italy are showing upward trends in their post-Covid spike of road deaths.

Many factors contributed to this surge in road fatality: more speeding due to less congested traffic, an increase in drunk driving, rising stress and mental health issues during the pandemic, to name a few. But when determining which age groups were most severely affected, there are two clear answers – the youngest and the eldest.

Young drivers, often referred to as Gen Z (ages 16-25), are still new and inexperienced compared to older generations. Due to their lack of driving knowledge and still-developing cognitive functions, their accident rates are higher than other age groups’. However, our data suggests that doesn’t necessarily stop them from believing and acting as if they are fully capable of driving safely. Just how (over)confident are they in believing they are accident-free drivers, and what can insurers do to tackle this issue?

This article illustrates Gen Z’s driving habits and attitude based on the recent consumer survey results. DriveQuant, an expert in research and product development of connected insurance specialized in driving behaviors to improve road safety and reduce the environmental impact of mobility, will give insights into how the data/physics-based analysis and connected insurance solutions they developed can help Gen Z drivers reduce their distractions and learn better driving skills.

(Over) Confident Gen Z Drivers?

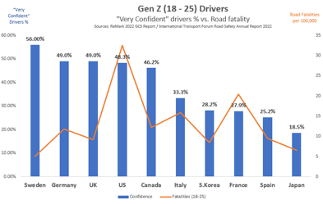

SCOR ReMark’s 2022 Global Consumer Study (GCS), based on over 12,700 consumers from 22 key insurance markets, found that many drivers are very confident, sometimes too confident in their driving skills, especially the Gen Z (Ages 16–25) generation. Figure 1 shows the percentage of Gen Z drivers rating themselves as “very confident” (in blue bars) and the actual road fatality rate by country (in the orange line).

The interesting fact is that the degree of confidence in their driving greatly varies by country. According to the result, young Swedish drivers are the most confident (56% of them giving themselves five stars), followed by Germany (49%), the UK (49%), the US (48%), and Canada (46%). Meanwhile, in Japan, only 19% of their young drivers say they are very confident. In Europe, Spain and France also have less confident drivers than their peer countries (25% and 28%, respectively). Will this match the actual road accident rates? Does their confidence in driving skills lead to fewer accidents? It does in certain countries such as Sweden, where the confidence meets the actual safe driving. But it is not the case in many other countries. A typical example is the US, which has the highest road fatality rate among young drivers, nearly six times higher than Sweden.

Figure 1: Gen Z drivers’ confidence and road fatality by country (Source: ReMark, International Transport Forum)

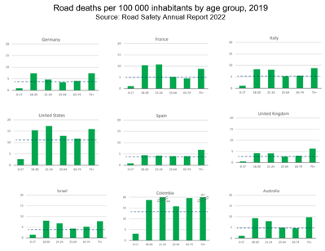

In most of the major insurance markets around the globe, this young generation yields the highest number of road death incidents (Figure 2). Clearly, their high confidence does not match up with their actual driving skills.

Figure 2: Road deaths per 100 000 inhabitants by age group, 2019 (Source: Road Safety Annual Report 2022)

So, as insurers, what should we do to address this issue? Should we just shrug it off, saying “They are young, inexperienced, yet too confident to listen to older adults’ advice. Nothing we can do,” and hope we won’t get high claims from young insureds or keep raising premiums for this age group?

We believe there is something more insurers can/should do to help. With the power of data and sophisticated analytics ability we possess, we should take a proactive approach to help this generation become safer drivers.

The first step is to have a deeper understanding of this young but distinctively unique generation. Why are they so confident yet have a high accident rate? What are in their minds, and what are their needs? What motivates them to become safer drivers? And more importantly, what can be done to improve their safe driving skills?

Let’s start with understanding this generation a little deeper. There are cultural/regional differences, but in general, Gen Zers have unique traits. Oxford Royale Academy described their character traits as 1) digital natives, 2) cautious, 3) accepting diversity, 4) health-conscious, 5) value privacy, and 6) entrepreneurial. Pew Research adds that this generation is also educated, open-minded, and progressive. They are all positive traits, but Gen Z also received negative reputations such as entitled, unrealistic, quick-reward-oriented, overconfident, etc. Research by Stanford University described Gen Z as collaborative, social, and deeply caring about climate change. World Economic Forum called Gen Z the most sustainability-conscious generation. And this is reflected in numbers related to driving, or lack of. More Gen Z walk, cycle, or use public transportation than other older groups. In the US, Gen Z are obtaining their driver’s licenses at lower rates.

Gen Z was also one of the hardest hits by the Covid-19 lockdown, often having suffered from social isolation and mental health challenges due to missing their normal high school and college years. So, there is an added complexity to this generation.

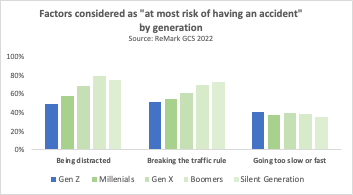

Next, let us take a deeper look at what is causing Gen Z’s high road fatality rate. In general, young drivers have higher accident rates due to several factors including: 1) speeding, 2) intoxicated while driving 3) distracted driving (texting, calling, etc.). While those three most significant causes are all important, one of the concerning factors is distracted driving - statistics show that this generation has the largest proportion of fatal crashes due to distracted driving. But here is a concerning fact – despite that fact, Gen Z do not seem to recognize the danger of distracted driving as much as other generations.

Here is data to prove this phenomenon. ReMark’s GCS survey results show that while the overall general population said distracted driving is the No.1 cause of road accidents, Gen Z is the only generation who did not list “being distracted (e.g., using a mobile phone)” as the No.1 risk factor (it was a close second, but it’s much lower than other generations) (Figure 3). Yet, this generation has one of the highest road death incidents, influenced by distracted driving more than other age groups.

Figure 3: Factors considered as “at most risk of having an accident” by generation (Source: ReMark GCS 2022 report)

Does data confirm Gen Z’s overconfidence in driving?

In addition to the above insights based on ReMark’s consumer survey, DriveQuant’s study on driving profiles of Gen Z provides other deep insights into this generation’s driving pattern and characteristics. DriveQuant, an innovative group of researchers, physicists, developers, and data scientists working together to understand driving behaviors and develop solutions to improve road safety and reduce the environmental impact of mobility, analyzed the driving behavior of around 3000 Gen Z drivers and divided them into three behavioral profiles: safe, average, and at-risk drivers with a percentage breakdown of each category. We will show the results and analysis in the following sections.

Three Behavioral profiles for young drivers

Safety score

|

At-risk |

Average |

Safe |

|

|

Score range |

< 8.2 |

8.4 - 8.8 |

> 9.2 |

|

Number of drivers (%) |

1050 (36%) |

1139 (39%) |

750 (25%) |

|

average score |

7.6 |

8.6 |

9.4 |

|

braking / 100 km |

30.5 |

17.2 |

7.9 |

|

acceleration / 100 km |

20.3 |

4.1 |

1.3 |

|

cornering / 100 km |

11.5 |

9.6 |

4.4 |

Figure 4 – Behavioral profiled for young drivers : safety score (source: DriveQuant)

The first thing to note from this analysis is that only 25% of Gen Z drivers are qualified as safe drivers, i.e., a safety score above 9.2 out of 10. 39% of Gen Z drivers are average drivers (8.4 - 8.8), while 36% are considered “at-risk” drivers, i.e., below 8.2 (Figure 4). Furthermore, a closer look at the three safety indicators (braking, speeding, cornering) reveals serious gaps between the three profiles.

When we look at hard braking, the data shows that average drivers brake about twice as much as the safest drivers, and at-risk drivers brake even more – four times as much as safe drivers. Given their lack of driving experience, it is unsurprising that most young drivers (75%) do not anticipate braking well enough. However, these large differences in the frequency of braking among the three profiles indicate that there is a lot of room for improvement and a need for guidance for average and at-risk drivers.

The difference is even more significant for speeding (acceleration), where at-risk drivers accelerate nearly 20 times more than safe drivers. These Gen Z safety scores reveal that our presumption was true – many young drivers are not as good as they think they are. Furthermore, DriveQuant's data also confirms that speeding is the first cause of accidents for young drivers, given the very high number of speeding and braking events collected by its mobile telematics solution.

Distraction score

Next, let’s look at their distraction score (Figure 5). Given the fact that Gen Z was the only generation that did not rank distracted driving as the number one risk factor for road accidents in the GCS survey, it is interesting to take a closer look at how they scored in this category.

The data reveals that only less than one in four young drivers (around 22%), are safe drivers, i.e., not distracted behind the wheel. For these drivers, it is interesting to note that when, although not frequently, they unlock their phone, it is generally to make or answer a phone call. Looking at unlocks per 100 km, we see that average drivers unlock their phones every 16 km, while risky drivers unlock their phones three times more often (every 5 km).

|

At-risk (distracted)

|

Average (neutral) |

Safe (not distracted) |

|

|

Score range |

< 6.5 |

7.6 - 8.4 |

> 9.0 |

|

Number of drivers (%) |

1 139 (38%) |

1 135 (39%) |

665 (22%) |

|

average score |

5.6 |

8.0 |

9.4 |

|

unlocks / 100 km |

20.0 |

5.6 |

1.4 |

|

unlocks / 10 trips |

23.5 |

7.1 |

1.8 |

|

calls / 1000 km |

16.5 |

4.9 |

1.4 |

|

percentage of trips with calls |

11.5 |

4.2 |

1.4 |

Figure 5 – Behavioral profiled for young drivers: distraction score (source: DriveQuant)

This data sheds light on why young drivers do not believe that distracted driving is the number one risk factor for road accidents. It is, in our opinion, because they are used to driving while being distracted. They do not even recognize texting and calling while driving as a highly risky act.

This raises, however, many questions: Are they aware that they are distracted behind the wheel? If they are, do they understand that their behavior is dangerous? If not, what can we do to make them aware? Given their “intimate” relationship with their phones, can we expect them to drive without using their phones at all? Why are 22% of young drivers not distracted? Are there differences between driving classes that explain why this group is not distracted?

Finding the right answers to these questions is not easy and will require further analysis. However, this should not stop insurers from taking action to encourage change. Some tools have shown interesting results in reducing distraction and improving road safety. One of these, namely connected insurance, is of particular interest to insurers.

What is the solution? Connected insurance!

Many industries leverage digital tools to make things better, faster, and more accessible. The insurance industry is no exception. One of the examples the industry is demonstrating its futuristic thinking by transforming the world with power of data and technology to make people’s lives better is connected insurance.

What exactly is connected insurance and how would it benefit the industry and consumers?

Connected insurance program and its benefit

While connected insurance is still not as well-known as traditional insurance among the general public, its popularity has been steadily rising since the beginning of the 2010s. The emergence of connected insurance arises from digitalization in the insurance industry and the explosion of the IoT (Internet of Things) market.

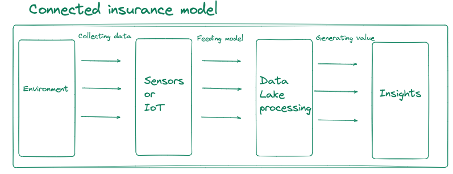

Figure 6 shows the flow of the connected insurance model. This form of insurance relies primarily on data coming from IoT or any other sensors or devices that collect data. Data is then gathered into a data lake to be processed and analyzed in order to eventually reveal hidden insights to insurers on the habits or behavior of their customers.

Figure 6: Connected insurance model

Connected insurance has found its way into many types of insurance. The most popular applications include:

-

In home insurance: fire detection systems, smart locks, energy management or water leakage detectors

-

In health insurance: health monitoring system

-

In life insurance: connected wellness services

In car insurance, connected insurance has led to the emergence of two new digital programs called:

- Usage-Based Insurance (UBI), also called Pay-As-You-Drive or Pay-As-You-Go

The insurance premium is based on car usage (mileage or driving duration). The behavior of the driver is not considered when pricing the premium.

-

Pay-How-You-Drive

The insurance premium is based on the driver's behavior.

Many insurers have already launched connected insurance programs. Examples include:

-

StateFarm, AllState, Progressive, Liberty, Lemonade in the US

-

DirectAssurance, Altima, Marmelade, Cuvva in the EU

-

Bimaleo, Santam in Africa

Connected programs target the general public but can also be specifically designed for young drivers or short-distance drivers. For instance, Marmalade is a UK-based insurtech that offers products targeting mainly learners and young drivers.

What are the benefits of connected insurance?

Connected insurance brings significant benefits to both insurers and policyholders. Here are the highlights of its key advantages:

For insurers

One of the most remarkable benefits of connected insurance is that it significantly improves insurance underwriting. It gives underwriters a tool they have long been waiting for: a never-ending stream of real-time data coming directly from the people they insure. Over time, with full exploitation of the data lakes, underwriters will better segment their portfolio by profiling more accurately the risk of their drivers.

With such a precise picture of the behavior of their customers, underwriters will be able to adjust insurance premiums accordingly. Beyond increasing customer loyalty, identifying high-risk drivers, such as those overconfident Gen Z drivers identified in our survey, is a golden opportunity for insurers to improve their behavior behind the wheel. This can be achieved by setting up tailored-made prevention programs that specifically target the shortcomings identified or by coaching them via in-app coaching. On the other hand, identifying the low-risk drivers is a great opportunity to launch incentive programs to retain them by offering them special benefits such as tools to reduce their fuel consumption, as seen later in this article.

Claims management is also deeply impacted by connected insurance. Following a First-Notification-Of-Loss (FNOL), the operator assistance can fact-check the accident by looking at the data collected seconds before, at the moment of, and after the crash. This provides a full picture of what happened and under which circumstances the crash occurred. With this information, the operator is able to make the right decisions quickly and better evaluate the damages, leading to great time and money savings for insurers.

Connected insurance goes even further to facilitate claim management because it offers unique features such as automatic crash detection. In the event of a road accident, for example, and if the driver is not answering a notification asking to confirm he or she is okay, an alert is sent automatically to the operator assistance with a full data report of the event. After a quick check of the data, the operator can call the insured to make sure he or she is not injured or call the emergency services immediately if the data indicate a severe crash with casualties.

Another benefit that should not be overlooked is the positive selection underlying connected insurance. Most people that opt for this type of mobile telematics programs, be it Pay-As-You-Drive or Pay-How-You-Drive, are low-risk drivers. This means that the portfolio of policyholders is healthier than mainstream portfolios, given that the highest-risk drivers have no interest in choosing this type of insurance.

Launching a connected insurance is also an opportunity to upgrade the customer experience. While traditional touchpoints are mainly renewal and loss-related, connected programs introduce a whole new customer experience by putting the mobile app at the heart of the experience, and as the main communication channel. This leads to a more direct relationship with the customers because they regularly open the app to check their mileage, journeys and access feedback on their driving style.

The insurers can also send notifications on their customers’ mobile to nurture their bond and even use incentives such as exclusive offers to push their customers to open the app. This feature will be particularly appealing to Gen Z drivers, who are known to love to be quickly rewarded and recognized for their accomplishment.

For the policyholders

From the policyholder’s point of view, the first and more tangible benefit is transparency. Many polls in various countries have revealed that people not only do not understand their coverage but, even worse, do not trust their insurers. Launching a connected insurance program is the best way for insurers to rebuild trust by making the price variables clear and providing customers with regular feedback on their mileage or behavior in the app.

Coaching is another benefit praised by customers following the reciprocity principle: customers share their driving data with their insurer and expect, in return, the insurer to give them feedback and personalized coaching. Personalized driving tips have many advantages, such as:

-

It provides thoughtful advice to young drivers and helps them compensate for their lack of experience behind the wheel,

-

It reminds experienced drivers that some unsafe driving habits they have adopted must be corrected.

The bonus aspect: connected insurance answers the environmental aspirations of Gen Z

Besides transparency and coaching, which are general benefits that affect all generations of drivers, connected insurance responds to specific expectations of Gen Z, such as environmental actions.

According to a poll published by the UN and the University of Oxford in 2022, 70% of young people under 18 believe climate change is a global emergency. This is the highest rate among all generations.

Another poll conducted by Accenture reveals that 67% of Millennials and Gen Z favor experiences that encourage sustainability. This means that brands that do not address climate change or who suffer from a poor green image because of their lack of motivation to act will undoubtedly struggle to interest and even more attract Gen Z customers.

Environmental issues and their consequences are not new to insurers whose activities have been deeply impacted by the rising number of environmental catastrophes in the last decades. While insurers have already taken many measures to reduce their environmental footprint (see what MAIF has done, for instance), they have not yet fully embraced climate actions in car insurance. Hopefully, connected programs are a step in the right direction to address Gen Z concerns, given their two main benefits for the environment. First, UBI or Pay-As-you-Drive promotes reasoned car mobility by pushing people to use alternative forms of mobility, and second Pay-How-You-Drive provides a means of action to people who have no choice but to drive by giving them a tool to learn eco-driving.

Let us go further into the details. Given that the more UBI policyholders drive, the more expensive their insurance premium will be, Pay-As-You-Drive offers are real leverages to push people to drive with parsimony and to opt for other means of transportation when available to preserve their finances. From an environmental point of view, this insurance product represents a new way to envision mobility and, indeed, favors a smooth transition toward sustainable mobility.

For people that cannot turn to alternative modes of transportation because they live outside cities or public transportation is irrelevant, connected insurance is still a great tool because Pay-How-You-Drive programs help them reduce their environmental footprint by teaching them how to eco-drive. Eco-driving is defined as an efficient way of driving, more environmental-friendly and more sustainable. It favors anticipation and speed reduction. Our research has demonstrated that drivers that adopt eco-driving save on average 10% on their fuel consumption and CO2 emissions.

By responding with immediate and impactful answers to the environmental concerns of Gen Z, connected programs tick all the boxes to attract and retain young drivers. But it goes even further by leveraging gamification as a way to engage Gen Z drivers towards better driving.

Gamification mechanisms: Benefits and challenges

Another connected insurance feature that may help Gen Z become safe drivers is gamification. According to McKinsey & Co., more than 70% of young people under 25 prefer playing video games to watching videos. Gen Z is the first digital-native generation that did not experience the pre-internet era. Given that they were born with digital tools and have always been using them, it is no surprise that they learn better by relying on digital tools such as their mobile devices and favor gamification over traditional learning methods.

Connected insurance meets the two criteria to incentivize Gen Z to drive better and safer. First, it is a digital product that relies on a mobile app. Secondly, it offers many gamification mechanisms to help young drivers improve their driving skills. Among those mechanisms, the most effective and engaging is the organization of driving challenges. To improve the driving skills of a group of young drivers, insurers can launch a driving challenge program where they can participate and compete. This is a particularly interesting tool to make Gen Z better drivers because it uses a communication channel they favor (mobile app), and it relies on values they defend, i.e., continuous learning and the desire to compete while having fun.

Our research has also shown that drivers that take part in a driving challenge immediately improve their driving style by more than one point on DriveQuant’s index score. Our record shows that for those who take part in several challenges a year, the results are even better.

Conclusion

Gen Z drivers, still in their teenage years or early 20s, have many more years of driving ahead of them. They are also the largest cohort alive, accounting for 26% in the global population. Named as the most sustainability-conscious generation, they have an enormous ability to create a more sustainable and cleaner environment. But they are still developing skills and needs help, no matter how confident they seem to be. Therefore, it is both interests and responsibilities of insurers to help them become safe and environmentally conscious drivers.

Targeting Gen Z drivers for connected insurance makes sense because, be it Pay-As-You-Drive or Pay-How-You-Drive formula, it responds to their generational expectations. Adding an eco-driving feature to the offering is even more ideal as it provides them with flexible solutions to reduce their environmental footprint, which they are passionate about, by encouraging them to turn to alternative forms of mobility to save money and adopt eco-driving to lower their impact when driving.

Connected insurance also ticks the box of their learning preferences by being digital first and offering them fun but impactful ways to become better drivers on the roads. If these benefits are not enough to convince insurers to offer connected insurance, here is one extra reward -, insurers can build a strong bond of trust with those young drivers, who are going to be their loyal customers for a long time, by being transparent and giving back values to the customers.

![[2025 Edition] The Guide to Connected Insurance](https://blog.drivequant.com/hubfs/7-%20%5BEdition%202025%5D%20Le%20Guide%20de%20lAssurance%20Connect%C3%A9e.png)